Are you overwhelmed by managing your personal finances? Do you dream of a simpler way to track your income, expenses, and savings goals? This comprehensive guide on how to create a personal finance dashboard you’ll actually use provides a step-by-step process to build a customized, user-friendly system. Learn how to leverage budgeting tools, financial tracking software, or even a simple spreadsheet to visualize your financial health, make informed financial decisions, and achieve your financial goals more effectively. Stop letting your finances control you; take control with a powerful personal finance dashboard today.

Why Dashboards Help You Stay on Track

A well-designed personal finance dashboard provides a centralized view of your financial health. Instead of sifting through multiple accounts and statements, you see a snapshot of key metrics like your net worth, income, expenses, and savings progress all in one place.

This immediate visibility fosters better awareness of your financial situation. You can quickly identify areas needing attention, such as unexpectedly high expenses or slow savings growth. This proactive approach allows for timely adjustments to your budget and financial strategies.

Furthermore, dashboards promote accountability. By regularly reviewing your dashboard, you’re consistently reminded of your financial goals and progress towards them. This visual representation of your finances encourages discipline and helps maintain focus on your long-term objectives.

Finally, dashboards offer a sense of control and empowerment. Rather than feeling overwhelmed by your finances, you gain a clear understanding of your position and the tools to navigate your financial journey effectively.

Choose the Right Tool: Spreadsheet or App

The foundation of your personal finance dashboard hinges on choosing the right tool. Spreadsheets, like Google Sheets or Microsoft Excel, offer granular control and customization. They’re excellent for those comfortable with formulas and data manipulation, allowing for complex calculations and personalized tracking.

Alternatively, personal finance apps provide a user-friendly interface with pre-built features. Many offer automated data import from bank accounts and credit cards, simplifying data entry. They often include budgeting tools, reporting features, and investment tracking, streamlining the process for less technically inclined users.

The best choice depends on your technical skills and desired level of customization. If you enjoy working with data and require highly specific calculations, a spreadsheet is ideal. If you prefer simplicity and automation, a dedicated personal finance app is a more efficient option.

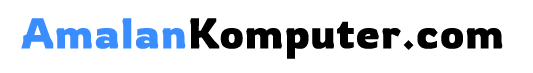

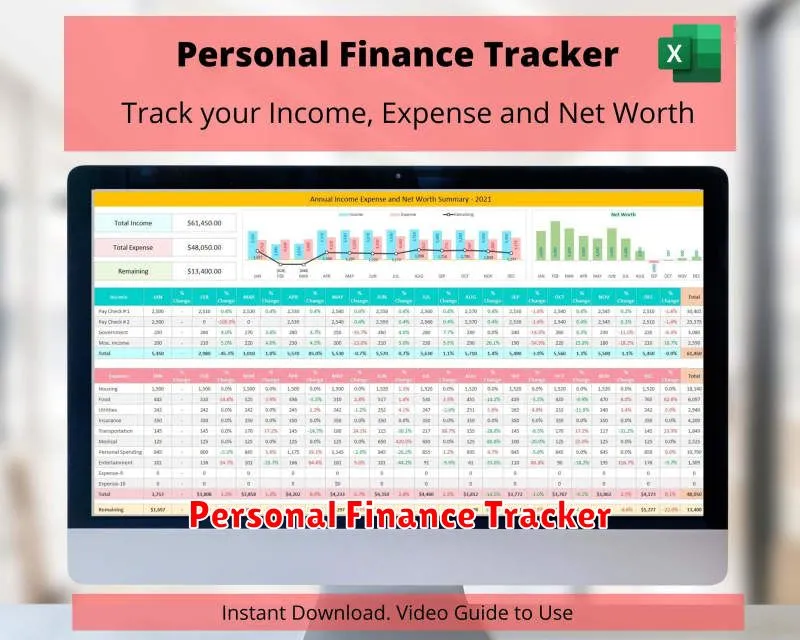

Track Income, Expenses, and Goals in One Place

A comprehensive personal finance dashboard should centralize your financial data for easy monitoring and analysis. This means integrating your income, expenses, and financial goals all within a single view.

Income tracking involves recording all sources of money, including salary, investments, and side hustles. Expense tracking requires meticulously logging all your spending, categorized for better understanding of your spending habits. This could involve using budgeting apps, spreadsheets, or dedicated personal finance software.

Integrating your financial goals is crucial. Clearly define your short-term and long-term objectives, such as saving for a down payment, paying off debt, or investing for retirement. The dashboard should allow you to track your progress towards these goals, providing motivation and a clear picture of your financial health.

By consolidating this information, you gain a holistic perspective on your financial situation, making informed decisions easier and more efficient. Visual representations, such as charts and graphs, can significantly improve the ease of understanding your financial progress.

Customize Based on Your Financial Priorities

Your personal finance dashboard should reflect your unique financial goals. Prioritize the metrics most relevant to your current situation. For example, if you’re saving for a down payment, prominently display your savings progress and debt reduction trackers. If retirement is your focus, emphasize your retirement account balances and investment performance.

Tailor the dashboard’s layout and features to support your specific needs. If you’re meticulous about budgeting, incorporate detailed budgeting categories and spending analysis tools. If you prefer a simpler overview, opt for a summary view showcasing key net worth and cash flow figures. The key is to create a dashboard that motivates you to engage with your finances and track your progress towards your financial objectives.

Regularly review and adjust your dashboard as your priorities evolve. What’s crucial today might be less important tomorrow. This adaptability ensures your dashboard remains a powerful and effective tool for managing your finances over the long term.

Update Weekly to Build Consistency

The key to a successful personal finance dashboard is consistent use. Without regular updates, your dashboard becomes obsolete and loses its value. Weekly updates are ideal for maintaining accuracy and fostering a habit.

Schedule a specific time each week, perhaps Sunday evening or Friday afternoon, to dedicate to updating your dashboard. This routine builds consistency and prevents the task from being overwhelming.

During your weekly update, review all key metrics, such as income, expenses, savings progress, and debt balances. Record any transactions missed, adjust budgets as needed, and note any significant financial changes.

Consistency in updating your dashboard will not only give you a clear picture of your financial health, but it will also cultivate a mindful approach to your spending and saving habits. The more you use it, the more valuable the tool becomes.

Visualize Your Progress with Charts

A personal finance dashboard isn’t complete without visual representations of your financial health. Charts are key to understanding your spending habits, saving progress, and debt reduction at a glance.

Consider using a bar chart to compare spending across different categories like housing, food, and entertainment. A line chart effectively showcases your net worth over time, illustrating the impact of your financial decisions. For debt reduction, a pie chart provides a clear picture of how much of your debt is attributed to each source (credit cards, loans, etc.).

Interactive charts offer even greater insight. Many dashboarding tools allow you to hover over data points for detailed information, or to filter data by specific time periods. This interactivity allows for deeper analysis of your finances and a more effective understanding of your progress.

Remember to choose chart types appropriate to the data you’re presenting. Clear, concise visualizations are crucial for motivating you to stay engaged with your personal finance dashboard and track your financial goals effectively.

Keep the Interface Simple and Motivating

A cluttered or confusing interface will quickly lead to abandonment. Simplicity is key. Prioritize displaying only the most crucial information: current account balances, monthly spending summary, and progress towards financial goals. Avoid overwhelming users with excessive detail or unnecessary charts.

To maintain motivation, incorporate visual elements that celebrate progress. Consider using progress bars to track savings goals or positive reinforcement through celebratory messages when milestones are achieved. Choose a color scheme that is visually appealing and calming. The overall design should be clean, easy to navigate, and feel encouraging rather than intimidating.

Regular updates are essential to keep the dashboard engaging. Automate data imports wherever possible, and consider adding features that allow for personalization, such as customized widgets or goal setting tools. A simple, well-designed, and motivating dashboard will significantly increase the likelihood of consistent use.