Feeling overwhelmed by debt? You’re not alone. Many struggle with managing personal finance and the stress of unpaid bills. This article provides practical strategies on how to stay debt-aware without succumbing to the overwhelming feelings often associated with financial struggles. We’ll explore effective techniques for budgeting, debt management, and cultivating a healthy relationship with your finances, empowering you to take control and build a more secure financial future.

Know Your Total Debt and Interest Rates

Understanding your total debt and associated interest rates is crucial for effective debt management. This involves compiling a complete list of all your debts: credit cards, loans (student, personal, auto, mortgage), and any other outstanding balances. For each debt, note the principal balance, the annual percentage rate (APR), and the minimum payment.

Calculating your total debt is simply the sum of all outstanding balances. Knowing your total interest rates requires a bit more attention; some debts will have fixed rates, while others may be variable. The average of your interest rates gives a broad picture of your overall borrowing cost, although the highest rates should receive the most attention as they impact your debt the most. Understanding these figures provides a clear starting point for creating a debt repayment strategy.

Regularly reviewing and updating this information will allow you to track your progress and make informed decisions. Tools like budgeting apps or spreadsheets can simplify this process.

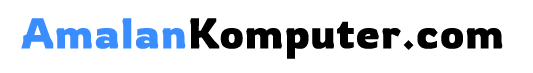

List Debts Visually in a Simple Chart

Creating a simple chart to visualize your debts can significantly improve your debt awareness without causing overwhelm. A bar chart is ideal for this purpose. On the horizontal axis, list each of your debts (e.g., credit card 1, student loan, car loan). On the vertical axis, represent the amount owed. The length of each bar should correspond to the amount of debt for that specific category.

Alternatively, a pie chart can effectively show the proportion of each debt to your total debt. Each slice represents a different debt, with its size proportional to the amount owed. This visualization helps you quickly grasp the relative significance of each debt.

Keep your chart simple and easy to understand. Avoid cluttering it with unnecessary details. The goal is to create a clear and concise overview of your debt situation, facilitating better understanding and informed decision-making.

Regularly update your chart as you make payments to track your progress and maintain a clear picture of your financial situation. This visual representation aids in staying motivated and on track towards becoming debt-free.

Create a Minimum + Extra Payment Plan

Managing debt effectively involves a strategic approach. Creating a “minimum + extra” payment plan is a key component of this strategy. This plan focuses on consistently paying the minimum amount due on all your debts while allocating any extra funds towards paying down a specific debt aggressively.

First, list all your debts, including the balance, minimum payment, and interest rate. This provides a clear overview of your financial obligations. Prioritize debts with the highest interest rates; these cost you the most in the long run.

Next, determine your monthly budget and identify how much extra money you can allocate towards debt repayment. Even small extra payments can significantly reduce the total interest paid and shorten the repayment period. Be realistic; adjust the extra amount if necessary to maintain a sustainable plan.

Finally, apply the “avalanche” or “snowball” method. The avalanche method focuses on paying the debt with the highest interest rate first, while the snowball method prioritizes the smallest debt to build momentum. Choose the method that best suits your financial psychology and goals. Remember to track your progress regularly and adjust your plan as needed.

By consistently following a “minimum + extra” payment plan, you’ll gain control of your debt, reduce stress, and accelerate your journey to financial freedom. Remember, consistency is key.

Avoid Comparing Your Progress to Others

One of the most crucial aspects of managing debt without succumbing to overwhelm is to avoid comparing your journey to others’. Everyone’s financial situation is unique, with varying incomes, expenses, and debt levels. Comparing yourself to someone who seems to be paying off their debt faster can lead to discouragement and self-doubt. This comparison ignores the nuances of individual circumstances and can hinder your motivation.

Focus instead on your own progress. Celebrate small victories and acknowledge the steps you are taking, regardless of how they compare to others’ experiences. Tracking your payments and seeing your debt decrease, even gradually, offers a powerful sense of accomplishment. Consistent effort, tailored to your own abilities and resources, is far more effective than striving to meet unrealistic expectations based on others’ journeys.

Remember that financial success is a personal journey. What works for one person might not work for another. Embrace your unique path and find strategies that align with your personal capabilities and financial realities. By shifting your focus from external comparisons to internal achievements, you can maintain a healthier and more sustainable approach to debt management.

Use the Avalanche or Snowball Method Intentionally

Feeling overwhelmed by debt is common, but strategically tackling it can alleviate stress. The Avalanche and Snowball methods offer structured approaches.

The Avalanche method prioritizes paying off debts with the highest interest rates first. This minimizes the total interest paid over time, saving you money in the long run. It’s mathematically efficient but can be demotivating if you start with a large, high-interest debt.

The Snowball method focuses on paying off the smallest debts first, regardless of interest rate. This provides quick wins and boosts morale, which can be crucial for maintaining motivation throughout the debt repayment journey. While less financially efficient, its psychological benefits are significant.

Intentionally choosing one method is key. Consider your personality and financial situation. If you thrive on efficiency and long-term savings, the Avalanche method might be suitable. If you need quick wins to stay motivated, the Snowball method could be better. Whichever you choose, consistently apply the chosen strategy for optimal results.

Celebrate Each Paid-Off Milestone

Feeling overwhelmed by debt is common, but acknowledging progress is crucial for maintaining motivation. Celebrating each paid-off milestone, no matter how small, provides a powerful psychological boost. This positive reinforcement combats feelings of being stuck and reinforces the effectiveness of your debt reduction strategy.

Consider celebrating the payoff of a small debt like a credit card or a small loan with a small reward. This could be anything from a nice dinner to a new book – something that brings you joy without incurring additional debt. The key is to associate the feeling of accomplishment with your progress.

Acknowledge your success. Track your progress visually, whether through a spreadsheet, debt payoff app, or even a simple chart on your wall. Seeing the tangible reduction of your debt visually can help boost your confidence and provide a sense of accomplishment. Each milestone, however small, is a step closer to financial freedom.

Remember, the celebration itself shouldn’t add to your debt. Focus on small, affordable rewards that reinforce positive behavior and encourage continued progress toward your financial goals. This consistent positive reinforcement is key to staying motivated and debt-aware without feeling overwhelmed.

Track Emotional Response to Debt Management

Managing debt effectively requires more than just financial planning; it demands emotional awareness. Tracking your emotional response to the debt management process is crucial for long-term success. Negative emotions like stress, anxiety, and frustration are common, and ignoring them can lead to poor decision-making and ultimately, failure.

A simple method is to maintain a journal, noting your feelings each time you engage with your finances. Did reviewing your statements cause anxiety? Did making a payment bring relief? Documenting these responses allows you to identify triggers and develop coping strategies. For example, if reviewing your accounts always triggers stress, consider scheduling this activity for a time of day when you feel more calm and composed.

Consider incorporating mindfulness techniques to manage emotional overwhelm. Practicing deep breathing or meditation can help regulate feelings and create a sense of calm when dealing with challenging financial situations. This will assist you in making rational, well-informed decisions instead of acting impulsively based on emotion.

Remember, acknowledging and addressing your emotional responses is a key component of sustainable debt management. By proactively tracking your feelings, you can navigate the process more effectively and prevent emotional setbacks from derailing your progress.