Creating a budget that truly aligns with your lifestyle can feel daunting, but it’s a crucial step towards achieving your financial goals. This guide will walk you through a practical process to design a personalized budget that works for you, covering everything from tracking your spending habits to setting realistic financial targets and implementing effective money management strategies. Learn how to effortlessly budget your income and finally gain control of your finances. Discover techniques to save money without sacrificing your lifestyle and achieve financial freedom.

Know Your Real Income and Expense Flows

Before designing a budget, accurately understanding your income and expense flows is crucial. This involves more than just looking at your paycheck. Consider all sources of income, including salary, bonuses, investments, and side hustles. Document every amount received, noting the frequency (monthly, weekly, etc.).

For expenses, track every outgoing transaction for at least a month. Utilize banking apps, spreadsheets, or budgeting apps to categorize spending. Be thorough, including seemingly insignificant purchases. Common categories include housing, transportation, food, utilities, entertainment, and debt payments. Identify areas where spending is excessive or could be reduced.

Analyzing this data reveals a clear picture of your financial situation. Compare your total income against your total expenses to determine your net income (income minus expenses). This provides a realistic basis for budget planning and allows you to make informed financial decisions.

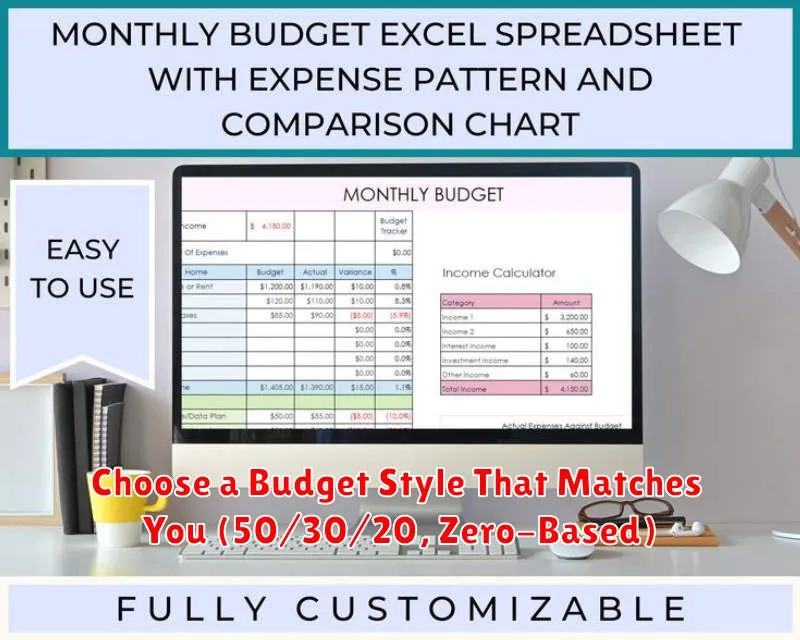

Choose a Budget Style That Matches You (50/30/20, Zero-Based)

Choosing a budgeting method that aligns with your personality and financial goals is crucial for long-term success. Three popular methods offer distinct approaches:

The 50/30/20 budget is a simple rule of thumb. It suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Its ease of use makes it ideal for beginners.

Zero-based budgeting involves meticulously allocating every dollar of your income to a specific category, ensuring your expenses equal your income. This method promotes mindful spending and helps identify areas for potential savings. However, it requires more time and effort.

Ultimately, the best budgeting style depends on individual preferences and circumstances. Consider your comfort level with detailed tracking and your ability to consistently monitor expenses. Experiment with different methods to find the one that best suits your needs and helps you achieve your financial objectives. Experimentation is key to finding the right fit.

Include a ‘Fun Money’ Category to Stay Consistent

Creating a realistic budget requires acknowledging all spending, including discretionary funds. Including a dedicated “fun money” category is crucial for maintaining consistency and preventing budget derailment. This prevents feelings of deprivation and promotes adherence to your financial plan.

Consistency is key. A predetermined, fixed amount allocated to fun money each month eliminates the need for constant recalculation and allows for better budgeting practices. This prevents impulsive spending and helps avoid exceeding your budget limitations.

By setting aside a specific amount for leisure activities – whether it’s dining out, entertainment, or hobbies – you gain a sense of control over your finances. This approach establishes a clear distinction between essential and non-essential spending, ensuring you don’t compromise your financial goals while still enjoying life’s pleasures. The specific amount allocated should be a sum you can comfortably afford without jeopardizing your financial security.

Remember, the goal isn’t to eliminate fun, but to manage it effectively within your overall budget. This balance promotes long-term financial health while maintaining a lifestyle you enjoy.

Use Digital Tools for Easy Tracking

Managing a budget effectively requires diligent tracking of income and expenses. Digital tools significantly simplify this process, offering features unavailable with manual methods.

Numerous budgeting apps and spreadsheet software are available. These tools allow for automated categorization of transactions, generating clear visuals of spending patterns. Features like expense tracking, budgeting, and financial goal setting make monitoring your financial health significantly easier.

Choosing the right tool depends on individual preferences and needs. Some users prefer the simplicity of budgeting apps, while others find the customizability of spreadsheets more appealing. Regardless of choice, the key is consistent use to maintain accurate records.

Utilizing digital tools empowers you to proactively manage your finances, identify areas for improvement, and ultimately achieve your financial goals more efficiently.

Update Budget Monthly Based on Life Changes

Life is dynamic, and your budget should be too. Monthly updates are crucial to ensure your financial plan remains relevant and effective. Significant life changes necessitate adjustments to your spending and saving strategies.

Consider these triggers for a budget review: a new job (with a different salary), a change in family size (children, marriage, divorce), unexpected expenses (home repairs, medical bills), or a significant purchase (a car, a house). These events directly impact your income and expenses.

When updating your budget, re-evaluate all categories. Adjust your housing, transportation, food, and entertainment allocations based on your current circumstances. Prioritize essential expenses and find areas where you can cut back or reallocate funds.

Regular review, even without major life changes, is beneficial. It promotes awareness of your spending habits and allows for proactive adjustments. This proactive approach helps prevent overspending and ensures your financial goals remain attainable.

By adapting your budget monthly, you maintain control over your finances and navigate life’s changes with greater financial stability and peace of mind.

Allow Flexibility for Special Events

Life is full of special occasions – birthdays, holidays, weddings, and unexpected events. A rigid budget can make these celebrations stressful. To avoid this, incorporate a dedicated “special events” category into your budget.

This category shouldn’t be a large portion of your income, but a small, contingency fund allows for flexibility. Consider allocating a percentage of your monthly income or a fixed amount to this fund. This ensures you can afford to celebrate without derailing your overall financial goals.

Remember, planning ahead is key. For predictable events like birthdays or holidays, save gradually throughout the year. This avoids last-minute financial strain and allows for more thoughtful celebrations. Unexpected events require a more adaptable approach; use the funds strategically to cover necessary expenses while staying within your overall budget.

Reward Yourself for Following the Budget

Sticking to a budget can be challenging, so incorporating a reward system is crucial for long-term success. This isn’t about splurging; it’s about acknowledging your progress and reinforcing positive financial habits.

Choose rewards aligned with your values. If you value experiences, plan a small outing. If you prefer material possessions, save towards a specific item. The key is to select something you genuinely desire, but that still fits within your budget.

Establish clear milestones. Decide on specific budget goals—perhaps saving a certain amount or consistently staying under budget for a set period—and link each milestone to a corresponding reward. This creates a sense of accomplishment and motivation.

Make it a celebration, not just a purchase. Take the time to enjoy your reward. This positive reinforcement will strengthen your commitment to your financial plan.

Remember the purpose. The reward isn’t the ultimate goal; it’s a tool to help you achieve your larger financial objectives. By celebrating your progress, you’ll stay motivated and on track towards your long-term financial well-being.