Are you ready to transform your financial future? This comprehensive guide, How to Build Daily Money Habits That Stick, provides actionable strategies to cultivate positive money habits. Learn how to establish a sustainable budget, master saving techniques, and develop a consistent financial plan that aligns with your goals. Discover practical tips and proven methods to break bad financial habits and build a secure financial foundation. This guide will empower you to take control of your finances and achieve lasting financial success.

Start the Day with a Quick Budget Check

Beginning your day with a brief budget check is a powerful way to cultivate mindful spending habits. This doesn’t require extensive time; even five minutes can make a difference.

A quick review allows you to stay aware of your current spending versus your budgeted amounts. This proactive approach prevents overspending and helps you track progress towards your financial goals.

Consider using a simple budgeting app or a spreadsheet to monitor your daily transactions. Note any unexpected expenses and adjust your spending accordingly for the remainder of the day.

This daily ritual promotes financial awareness and helps you make conscious decisions about your money, ultimately leading to better financial health.

Track Every Expense Before Sleep

Developing a strong financial foundation requires consistent effort. One effective technique is to track every expense before sleep each day. This simple act fosters mindful spending and enhances awareness of your financial habits.

Use a notebook, spreadsheet, or budgeting app to meticulously record every transaction, no matter how small. Include the date, description, and amount. This detailed record provides a clear picture of your daily spending patterns, helping identify areas where you can potentially save.

The nightly review facilitates immediate reflection. You’ll gain insight into impulsive purchases or unexpected expenses. This self-awareness is crucial for making informed financial decisions the following day. This consistent practice cultivates a habit of financial mindfulness, transforming your relationship with money from impulsive to intentional.

Consistency is key. Make this a non-negotiable part of your evening routine, similar to brushing your teeth. The effort invested will significantly contribute to building lasting, positive money habits.

Transfer a Small Amount to Savings Daily

Establishing a daily savings habit, even with a small amount, is a powerful way to build long-term financial security. Consistency is key. Start by identifying a manageable amount you can comfortably transfer each day. This could be as little as $1 or $5, depending on your budget.

Automate the process whenever possible. Most banks offer features allowing you to schedule automatic transfers from your checking to your savings account. This eliminates the need for manual transfers, reducing the likelihood of forgetting and ensuring consistent savings.

Consider linking your savings goal to a specific purpose, such as an emergency fund, a down payment, or a vacation. This will provide motivation and a clearer picture of your progress. Regularly reviewing your savings balance can reinforce the positive impact of your daily contribution and encourage continued financial discipline.

While the daily amount might seem insignificant on its own, the cumulative effect over time is substantial. The power of compounding ensures your savings grow significantly faster than you might initially expect. This approach fosters a mindful relationship with your finances, promoting better spending habits and long-term wealth building.

Avoid Unplanned Online Purchases

One of the biggest obstacles to building strong money habits is impulse online shopping. These unplanned purchases quickly add up, eroding your savings and hindering your financial goals. To overcome this, establish a pre-purchase waiting period. Before buying anything online, wait at least 24 hours. This allows time for the initial desire to subside, helping you assess whether the item is truly needed or just a fleeting want.

Additionally, unsubscribe from marketing emails and remove tempting apps from your phone. These constant reminders can trigger impulsive buys. Instead, focus on creating a realistic budget and sticking to it. Track your spending diligently to identify areas where you can reduce expenses and redirect funds towards your financial priorities. Remember, mindful spending is key to long-term financial stability.

Finally, cultivate the habit of needs versus wants. Before making a purchase, ask yourself: Do I truly need this item, or do I simply want it? This simple question can significantly reduce impulsive online spending and strengthen your financial discipline.

Practice Gratitude for Financial Wins

Cultivating a mindset of gratitude is crucial for building lasting positive money habits. When you experience a financial win, whether it’s a small bonus or a larger investment payoff, take a moment to acknowledge and appreciate it. This simple act of gratitude reinforces positive feelings associated with financial success and motivates you to continue making smart financial decisions.

Expressing gratitude, either through journaling, meditation, or simply reflecting on your achievements, helps shift your perspective from scarcity to abundance. This shift can reduce stress related to finances and foster a healthier relationship with money. By actively noticing and appreciating your financial gains, you build a foundation for continued growth and improved financial well-being.

Remember that even small wins deserve recognition. A paid bill on time, a successful budget month, or avoiding an unnecessary purchase all contribute to your overall financial health. Regularly practicing gratitude for these smaller victories will build momentum and help you stay motivated on your financial journey.

Reflect Weekly on Money Challenges

Regular reflection is crucial for building lasting money habits. Dedicate some time each week – perhaps Sunday evening – to review your spending and progress towards your financial goals.

This weekly review shouldn’t be a source of guilt, but rather a tool for self-awareness. Identify areas where you exceeded your budget or faced unexpected expenses. Analyze spending patterns and pinpoint triggers for impulsive purchases.

Use this time to adjust your budget accordingly. If you consistently overspend in a certain category, explore ways to reduce expenses or increase your income. The key is to make informed adjustments based on real-time data, rather than letting challenges go unaddressed.

By consistently reflecting on your financial journey, you cultivate a deeper understanding of your financial behavior, making it easier to maintain positive money habits and achieve long-term financial well-being.

Use Habit Stacking to Reinforce Financial Actions

Habit stacking is a powerful technique to build lasting financial habits. It involves linking a new financial behavior to an existing habit. For example, after brushing your teeth (an existing habit), you could immediately check your investment portfolio (the new financial habit).

Consistency is key. The existing habit should be something you already do daily and automatically. The more ingrained the existing habit, the more likely you are to successfully incorporate the new financial action.

Start small. Don’t try to overhaul your financial life overnight. Begin with one simple financial action linked to a well-established habit. Once that becomes automatic, add another.

Examples of habit stacking for finance include: checking your bank account after your morning coffee, transferring money to savings after paying bills, or reviewing your budget after lunch.

By strategically using habit stacking, you can effortlessly integrate positive financial actions into your daily routine, making them second nature and significantly increasing the likelihood of long-term success in your financial goals.

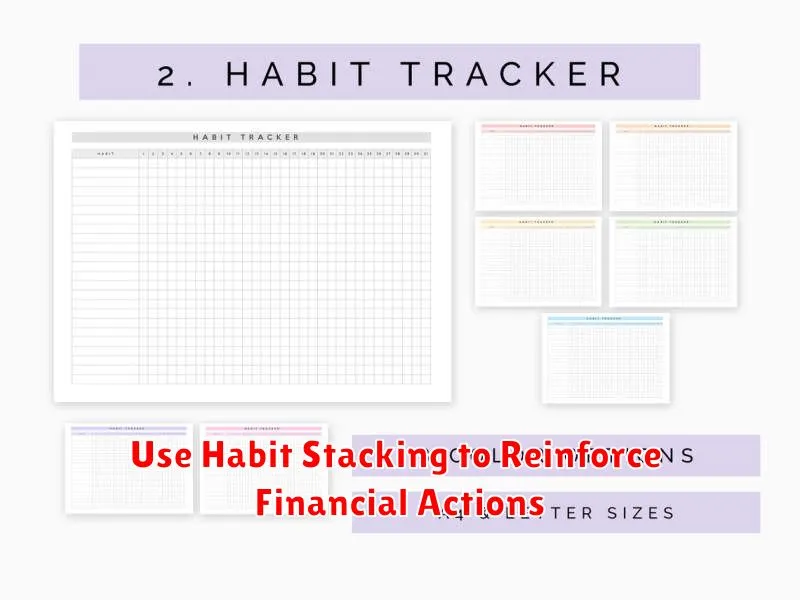

Visualize Progress Using a Journal or Chart

Tracking your financial progress is crucial for building lasting money habits. A simple yet effective method is to visualize your achievements using a journal or chart. Regular journaling allows you to document your daily financial activities, noting expenses, income, and savings goals. This provides a clear record of your actions and their impact.

Alternatively, a progress chart offers a visual representation of your financial journey. You can create a simple chart tracking your savings, debt reduction, or any other financial goal. Seeing the upward trend provides powerful motivation and reinforces positive behavior. The visual aspect makes it easier to understand your progress and stay committed to your goals.

Whether you choose a journal or chart, the key is consistency. Regularly updating your chosen method will keep you engaged and accountable, ultimately leading to the formation of sustainable money habits.