Are your financial decisions truly reflecting your values? Many people unknowingly create a disconnect between their financial actions and what’s truly important to them. This article will guide you through a practical process to align your finances with your values, ensuring your money works towards a life that feels authentic and purposeful. Discover how to make conscious financial choices that support your core beliefs and contribute to a life of greater meaning and fulfillment.

List the Top 5 Values That Matter Most to You

Identifying your core values is crucial for aligning your financial actions with your life goals. Consider what truly matters to you, beyond just accumulating wealth. To illustrate, here’s a potential list, but you should personalize this based on your own life:

1. Family Security: This prioritizes providing for loved ones and ensuring their well-being, both materially and emotionally. Financial decisions might focus on life insurance, creating an emergency fund, or securing a stable income.

2. Financial Independence: Achieving freedom from financial worries and the ability to make choices without being constrained by money. This involves planning for retirement, managing debt, and strategically investing.

3. Personal Growth: Investing in your education, skills, and experiences is essential for fulfillment. This could translate to budgeting for courses, workshops, or travel opportunities that expand your horizons.

4. Giving Back: Contributing to causes you care about demonstrates compassion and enriches your life. This might mean charitable giving, volunteering your time, or supporting ethical businesses.

5. Experiences over Things: Prioritizing experiences, like travel and unique events, over material possessions often leads to greater happiness and fulfillment. This involves mindful spending and budget allocation towards creating lasting memories.

Remember, these are examples. Reflect on your own personal values and tailor this list to reflect what truly matters most to you. This personalized list will then guide your financial decisions, leading to greater satisfaction and alignment between your money and your life.

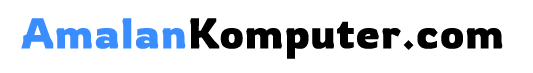

Review Last Month’s Spending for Alignment

To effectively align your financial actions with your values, begin by reviewing your spending from the previous month. This crucial first step provides valuable insight into your actual spending habits.

Categorize your expenses. Identify where your money went – groceries, entertainment, transportation, savings, debt payments, etc. This detailed breakdown will highlight areas of potential misalignment between your spending and your stated values.

Compare your spending categories to your prioritized values. For example, if you value environmental sustainability, did your spending reflect this? Did you prioritize local and sustainable food sources? Or did you spend heavily on fast fashion, contradicting your values?

Honest self-reflection is key. This review isn’t about judgment; it’s about gaining a clear understanding of your current financial reality. Identifying discrepancies between your spending and your values allows for targeted adjustments in the future.

By using this honest assessment as a foundation, you can create a budget that truly reflects your values, leading to more conscious and fulfilling financial decisions.

Highlight Spending That Supports Your Values

Identifying where your money goes is the first step. Tracking your spending, even for a short period, reveals spending patterns. This allows you to see which purchases align with your values and which ones don’t.

Next, categorize your spending. Create categories reflecting your values, such as “ethical fashion,” “sustainable food,” or “local community support.” This categorization visually highlights where your money is truly going.

Finally, actively highlight spending that supports your values. Use budgeting apps or spreadsheets to color-code or otherwise visually emphasize these purchases. This creates a positive reinforcement loop, encouraging more mindful spending aligned with your priorities. Seeing these positive choices in your spending clearly will motivate you to continue making ethical and value-driven financial decisions.

Cut Expenses That Conflict With Priorities

Identifying expenses that contradict your values is crucial for aligning your finances with your priorities. Honest self-reflection is key. Ask yourself: Which spending habits detract from what’s truly important to you?

For example, if family time is a priority, yet you’re spending heavily on eating out or entertainment that keeps you away from your loved ones, adjustments are needed. Similarly, if environmental sustainability is a value, reducing consumption of disposable products and prioritizing eco-friendly options aligns your spending with your beliefs.

Start by tracking your spending to pinpoint areas where you’re overspending relative to your priorities. Categorize your expenses to identify those that pull you away from your long-term goals. Then, create a budget that prioritizes your values, consciously cutting back on less important expenditures to free up resources for those aligned with your life goals.

Remember, this is about making conscious choices. Cutting expenses that don’t align with your values isn’t about deprivation; it’s about intentional spending that reflects your priorities and creates a sense of purpose in your financial life.

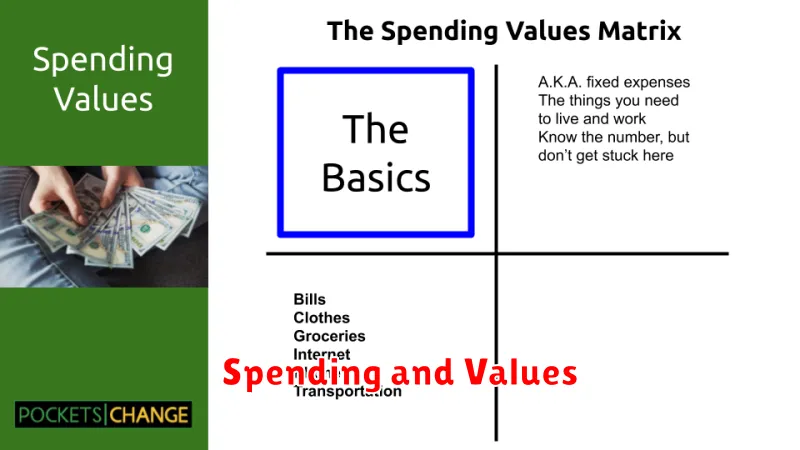

Use a Monthly Value-Based Budget Template

Aligning your finances with your values requires a structured approach. A monthly value-based budget template is a crucial tool for this. This template differs from traditional budgets by prioritizing spending based on your personal values, not just tracking income and expenses.

Start by identifying your core values. Are they family, travel, education, or charitable giving? Assign a percentage of your income to each value. This percentage reflects your commitment to each area. For example, if family is paramount, you might allocate a larger portion to groceries, childcare, and family outings.

The template should include categories reflecting these values. For instance, instead of a generic “entertainment” category, you might have “family fun,” “personal enrichment,” or “cultural experiences,” aligning spending with specific values. Track your spending meticulously, comparing actual expenditure to your allocated percentages. This provides insights into whether your spending matches your priorities. Regularly review and adjust your allocations as your values or financial circumstances evolve.

Using a value-based budgeting template empowers you to make conscious financial decisions that reflect what truly matters to you. This ensures your money actively supports your life goals and personal values, fostering a stronger connection between your finances and your well-being.

Track Emotional Satisfaction from Spending

Understanding the emotional impact of your spending is crucial for aligning your finances with your values. Tracking your emotional response to purchases—whether it’s joy, guilt, or indifference—provides valuable insight. Use a simple journal or spreadsheet to record your purchases and rate the emotional satisfaction on a scale (e.g., 1-5). Over time, this data reveals spending patterns and helps identify areas where your spending aligns or clashes with your values.

For example, consistently low satisfaction scores from dining out might indicate a need to re-evaluate your eating-out habits. Conversely, high satisfaction scores from experiences like travel or contributing to charity may confirm these are valuable uses of your funds. This self-reflection helps in making more intentional financial decisions, improving your overall well-being.

Analyzing this emotional data allows you to consciously redirect spending toward activities and purchases that truly resonate with your values. This mindful approach moves beyond simply budgeting and empowers you to spend money in a way that fosters genuine happiness and fulfillment.

Adjust Budget Categories Accordingly

Aligning your finances with your values requires a careful examination of your spending habits. This involves adjusting your budget categories to reflect your priorities. Identify your core values – are they family, travel, education, or environmental sustainability?

Once identified, allocate more funds to categories that directly support those values. For example, if family is a priority, increase your grocery budget for healthier meals and allocate funds for family outings. If education is key, boost your savings for courses or your children’s tuition.

Conversely, reduce spending in areas that contradict your values. If environmental sustainability is important, decrease spending on single-use plastics and fast fashion. This realignment ensures your money actively reflects your beliefs.

Regularly review and adjust your budget categories. Your values and priorities may shift over time, requiring adjustments to your spending habits to maintain alignment. This continuous evaluation is crucial for consistent financial integrity.