Are you ready to take control of your finances and break free from overspending? This comprehensive guide, How to Build a No-Spend Challenge That Actually Works, will equip you with the proven strategies and practical tools you need to succeed in a no-spend challenge. Discover how to create a personalized plan that fits your lifestyle, overcome common challenges, and achieve your financial goals. Learn to budget effectively, identify your spending triggers, and build lasting healthy financial habits. This isn’t just about temporary restriction; it’s about gaining financial freedom.

What Is a No-Spend Challenge and Why It Helps

A no-spend challenge is a period of time, typically a month or longer, where you commit to abstaining from all non-essential spending. This means foregoing purchases outside of necessities like rent, groceries, and essential bills.

The benefits are numerous. A no-spend challenge can significantly boost your savings, allowing you to build an emergency fund or pay down debt more rapidly. It also helps you develop greater financial awareness, revealing spending habits you might not have noticed otherwise. By reducing impulsive purchases, it cultivates mindfulness and a greater appreciation for what you already own.

Furthermore, a no-spend challenge can provide a sense of accomplishment and control over your finances. This can lead to improved mental well-being, reducing stress associated with financial anxieties. It fosters a more intentional and sustainable approach to spending, ultimately leading to better financial health in the long run.

Set Clear Rules and Categories Before You Begin

A successful no-spend challenge hinges on clearly defined rules and categories. Ambiguity leads to loopholes and ultimately, failure. Begin by specifying the duration of your challenge – a week, a month, or longer. Then, meticulously list allowed and disallowed expenses.

Categorizing expenses is crucial. Consider separating necessities (groceries, rent/mortgage, utilities) from wants (eating out, entertainment, online shopping). This allows you to track spending in specific areas and identify potential weaknesses. Be realistic and specific; avoid vague terms. For instance, instead of “eating out,” specify “restaurant meals” and even set a weekly limit. The more detailed your categories and rules, the more effective the challenge will be.

Account for exceptions. Will you allow yourself small, pre-planned indulgences? If so, define what constitutes a “small indulgence” and set a budget. This will help prevent unplanned spending and feelings of deprivation. Document all your rules and categories; this written record will be your guide throughout the challenge.

Choose a Realistic Time Frame (Day, Week, Month)

Selecting a realistic timeframe is crucial for a successful no-spend challenge. While a single day might seem easy, it offers limited impact. A week-long challenge provides a good starting point, allowing you to establish habits and identify spending triggers. A month-long challenge offers a more substantial experience, potentially leading to significant savings and a deeper understanding of your spending patterns. However, a longer duration increases the risk of burnout. The optimal timeframe depends on your individual circumstances and commitment level. Start with a shorter period if you’re new to such challenges to build confidence and then gradually increase the duration as you gain experience.

Consider your personal goals. Are you aiming for a quick win to boost motivation, or do you seek lasting behavioral change? A shorter timeframe is suitable for quick wins, while a longer period fosters sustainable habits. Assess your lifestyle; busy schedules may make a longer challenge difficult to sustain. Remember, success is measured by consistency, not duration. A shorter, successfully completed challenge is more effective than a longer one abandoned prematurely.

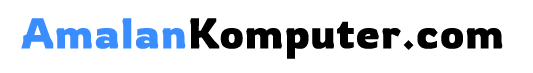

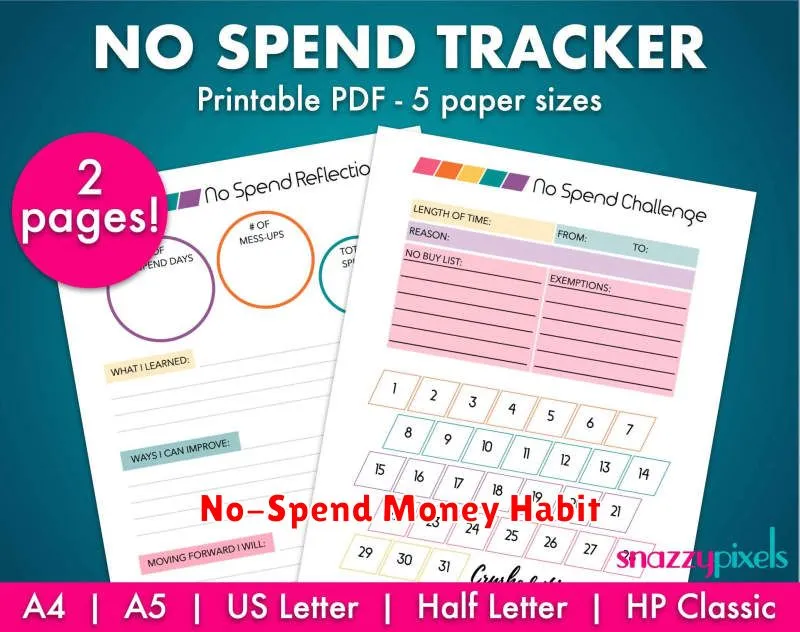

Track Progress with a Printable or App

Tracking your progress is crucial for a successful no-spend challenge. Consistency is key, and a visual record helps maintain motivation. You have two primary options: a printable tracker or a budgeting app.

A printable tracker offers a simple, tangible method. Many free templates are available online, allowing you to customize it to your specific needs. Simply print it out and check off each day you remain within your spending limits. The physical act of marking your progress can be surprisingly effective.

Alternatively, a budgeting app provides a more comprehensive approach. Many apps offer features beyond basic tracking, including expense categorization, goal setting, and progress visualization. This digital method offers convenience and detailed analysis, though it might require a learning curve depending on the app you choose. Choose the method that best suits your personal preferences and technological comfort level.

Find Free Alternatives for Fun and Entertainment

A successful no-spend challenge requires finding free alternatives to your usual entertainment expenses. This doesn’t mean sacrificing fun; it simply means getting creative.

Explore free activities in your community. Many cities offer free concerts, parks, museums (often on specific days), and walking tours. Leverage free online resources such as free movies or TV shows through streaming services you already subscribe to (with careful attention to your data usage!), podcasts, audiobooks from your library, and YouTube channels offering educational or entertaining content.

Focus on free social interactions. Instead of expensive dinners or outings, host a game night at home, organize a potluck with friends, or simply enjoy a conversation walk. Rediscover hobbies that don’t require spending money. Reading, writing, drawing, and learning a new skill online are all viable options.

Planning is key. Schedule free activities in advance to avoid impulsive spending. Having a pre-determined plan of free entertainment ensures you stay on track during your no-spend challenge.

Reflect on Emotional Spending Triggers

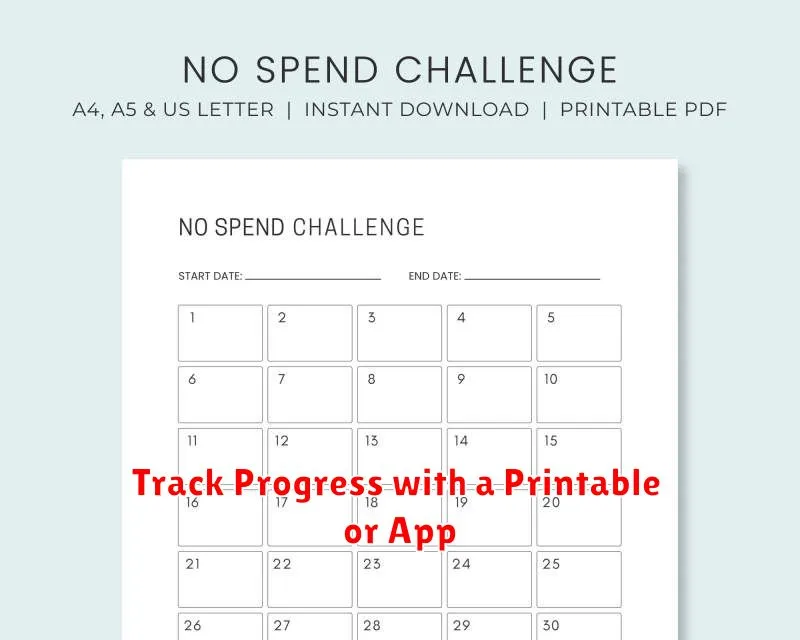

Understanding your emotional spending triggers is crucial for a successful no-spend challenge. Take time to honestly reflect on past spending habits. What emotions – boredom, stress, sadness, loneliness, or even excitement – typically precede a purchase? Keeping a spending journal can be invaluable in identifying these patterns.

Identify specific situations that lead to impulsive spending. Is it scrolling through social media? Feeling overwhelmed at work? Recognizing these contexts allows you to proactively avoid them or develop coping mechanisms during a no-spend challenge. For example, if online shopping is a trigger, consider uninstalling shopping apps from your phone.

Once you’ve identified your triggers, develop healthy alternatives. Instead of shopping to alleviate stress, try exercise, meditation, or spending time with loved ones. Finding productive and fulfilling activities to replace impulsive spending is key to breaking the cycle.

Remember, self-awareness is the first step towards controlling emotional spending. By understanding your triggers and developing strategies to manage them, you significantly increase your chances of succeeding in your no-spend challenge and building healthier financial habits.

Celebrate Completion Without Spending More

Successfully completing a no-spend challenge deserves a celebration! However, the point of the challenge is to curb spending. Therefore, finding ways to mark the occasion without breaking the bank is crucial.

Creative and Free Celebrations: Consider planning a free activity like a hike in nature, a picnic in the park, or a movie night at home with popcorn and homemade treats. Free digital celebrations: Connect with friends and family via video call or plan an online game night.

Low-Cost Celebrations: If a small expense is acceptable, perhaps treat yourself to a single affordable item that you’ve been wanting for a while, or purchase ingredients for a special home-cooked meal. Focus on the achievement: Remember, the true reward of a successful no-spend challenge is the accomplishment itself; the feeling of empowerment and financial control. Let that feeling be your celebration.

By focusing on the intrinsic rewards and employing creative, budget-friendly ideas, you can celebrate your success without compromising your hard-earned progress.