Are you ready to transform your financial future? This article reveals a proven system: How to Create a Weekly Money Ritual That Builds Wealth. Discover the power of consistent financial habits and learn practical steps to establish a personalized weekly money ritual designed to cultivate abundance and build lasting wealth. We’ll explore effective strategies for saving, investing, and managing your finances, ultimately empowering you to achieve your financial goals.

Pick a Weekly Time Slot and Protect It

Establishing a consistent weekly time slot dedicated to your financial well-being is crucial for building a robust money ritual. This dedicated time, even if just 15-30 minutes, allows you to focus intently on your financial goals without distractions.

Choose a time that best suits your schedule and energy levels. Whether it’s early morning, during your lunch break, or in the evening, consistency is key. Treat this time as an important appointment you cannot miss.

Protect this time fiercely. Avoid scheduling other activities during this period. Let your family and friends know that this is your dedicated financial planning time, ensuring uninterrupted focus. This dedicated time fosters a mindful approach to wealth building.

This consistent, protected time slot creates a habit, anchoring your money ritual and making it an integral part of your weekly routine. The more consistently you engage, the more powerful your money ritual becomes.

Review Your Transactions and Budget Gaps

Regularly reviewing your transactions is crucial for effective money management. Use online banking or budgeting apps to easily track your spending. Compare your actual spending against your budgeted amounts for each category (housing, food, transportation, etc.).

Identifying budget gaps – where spending exceeds your budget – is vital. Analyze these gaps to understand the cause. Are you overspending on entertainment? Eating out too much? Pinpointing these areas allows for focused adjustments to your spending habits.

This review process shouldn’t be a source of guilt, but rather a tool for self-awareness and improvement. By understanding your spending patterns, you can make informed decisions and reallocate funds to achieve your financial goals.

Consider using a spreadsheet or budgeting app to visualize your spending and budget gaps clearly. This visual representation can highlight areas needing immediate attention and facilitate better financial planning for the upcoming week.

Transfer Money to Savings or Investments

A crucial element of any successful wealth-building strategy is the consistent transfer of funds from your checking account to dedicated savings and investment accounts. This automated process ensures that a portion of your income is automatically set aside before you have the chance to spend it.

Automate the process: Schedule regular, automated transfers to your savings and investment accounts. This could be a weekly or bi-weekly transfer, depending on your income and financial goals. Even small, consistent amounts add up over time.

Diversify your accounts: Consider allocating funds to both high-yield savings accounts for short-term needs and investment accounts (such as brokerage accounts or retirement accounts) for long-term growth. The specific allocation will depend on your individual risk tolerance and financial objectives.

Set realistic goals: Determine a percentage of your income to allocate to savings and investments. Start small if necessary, and gradually increase the amount as your income grows and your financial comfort level improves. Consistency is key.

Review and adjust: Regularly review your savings and investment strategy to ensure it aligns with your evolving financial goals and risk tolerance. Make adjustments as needed, but maintain the discipline of consistent transfers.

List What Went Well and What Needs Work

Implementing a weekly money ritual requires consistent effort and self-reflection. What went well often includes increased awareness of spending habits, improved budgeting practices, and a stronger sense of financial control. The ritual itself, whether it’s reviewing finances, setting savings goals, or engaging in gratitude practices related to finances, can foster a more positive relationship with money.

However, what needs work frequently centers around maintaining consistency. Life’s demands can easily disrupt even the best-laid plans. Sticking to the schedule, particularly during stressful times, proves challenging for many. Additionally, accurately tracking income and expenses, and honestly assessing financial progress, remains crucial but often difficult for some. Finally, effectively adjusting the ritual based on changing financial circumstances requires adaptability and sometimes professional guidance.

Adjust Spending Limits and Priorities

Creating a weekly money ritual requires a conscious effort to manage your finances. A crucial step is adjusting your spending limits and priorities. Begin by honestly assessing your current spending habits. Track your expenses for a few weeks to identify areas where you’re overspending.

Next, categorize your expenses into needs and wants. Needs are essential for survival (housing, food, utilities), while wants are discretionary (entertainment, dining out). Prioritize allocating a larger portion of your income to needs, ensuring they’re fully covered before addressing wants.

Set realistic spending limits for each category. Utilize budgeting apps or spreadsheets to monitor your progress. Consider using the 50/30/20 rule as a guideline: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework helps create a balanced approach to managing your finances.

Regularly review and adjust your spending limits and priorities. Life circumstances change, and your financial goals may evolve. By consistently adapting your approach, you ensure your money ritual remains effective in helping you build wealth.

Check In With Your Financial Goals

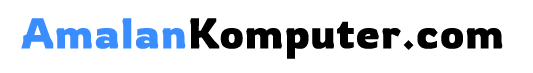

A crucial element of any successful wealth-building strategy is regular review of your financial goals. This weekly check-in shouldn’t be a tedious process; instead, make it a concise and insightful review.

Review your progress: Briefly assess your spending against your budget. Did you stay on track? Where were you over or under budget? This awareness fosters better control.

Evaluate your investments: Take a quick look at your investment portfolio. While daily monitoring is unnecessary, a weekly overview allows you to catch significant changes and make informed decisions.

Reassess your goals: Life circumstances change. Your weekly check-in is an opportunity to ensure your financial goals are still aligned with your current aspirations and priorities. Adjust your strategy as needed.

By consistently checking in with your financial goals, you maintain focus, accountability, and adaptability, vital components in achieving lasting financial success.

Reflect and Reaffirm Why You’re Doing This

A crucial element of any successful wealth-building strategy is consistent motivation. Your weekly money ritual should not be a mere chore, but a conscious act aligned with your deeper financial goals. Take time each week to reflect on why you’re committed to this process.

Reconnect with your initial reasons for wanting financial abundance. Are you aiming for financial freedom, to secure your family’s future, or to pursue a specific dream? Visualizing these aspirations will reignite your commitment and provide the necessary drive to continue your efforts.

Acknowledge your progress and celebrate your achievements, however small. This positive reinforcement is vital in maintaining momentum and combating any feelings of discouragement that may arise. By consistently reaffirming your “why,” you ensure that your weekly money ritual remains a powerful tool in your journey towards lasting wealth.